Indian companies often send their employees abroad for various work assignments. However, a common question arises when these employees, while rendering services outside India, have their salaries deposited into their Indian bank accounts. This situation can become complex, especially when the employees attain non-resident status. The key issue revolves around whether the salary paid in India remains taxable in the country.

Case Background:

In a recent case, an individual taxpayer worked as an employee of an Indian entity and was seconded for a short-term assignment to the company’s parent company in the USA. During the secondment, the taxpayer remained on the Indian entity’s payroll, and his salary for the services provided overseas was credited to his Indian bank account. Subsequently, he transitioned to employment with the foreign entity. He became a tax resident of the USA, which made him eligible to benefit from the India-USA tax treaty provisions under Section 90 of the Income Tax Act.

Understanding the Taxability of a Non-Resident

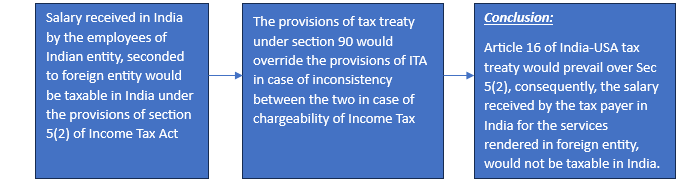

Section 5(2) of the Income Tax Act states that non-resident taxable income includes income received or deemed to be received in India and income that accrues or arises or is deemed to accrue or arise in India.

Article 16 of the DTAA:

Article 16 of the India-USA tax treaty specifies that salaries, wages, and similar remuneration received by a resident of one contracting state in connection with employment shall be taxable only in that state, unless the employment is exercised in the other contracting state.

Analyzing Article 16 of the DTAA:

Article 16 of the India-USA tax treaty clearly dictates that salaries earned by a resident of the USA in connection with employment shall only be taxable in the USA.

Section 90 of the Income Tax Act empowers the Central Government to enter into agreements with foreign governments for tax relief and the avoidance of double taxation. It also specifies that provisions of the Act shall apply to the extent they are more beneficial to the individual.

In this context, Article 16 of the India-USA tax treaty prevails over Section 5(2) of the Act. As a result, the salary received by the taxpayer in India for services rendered in the USA was not subject to taxation in India.

In a Nutshell