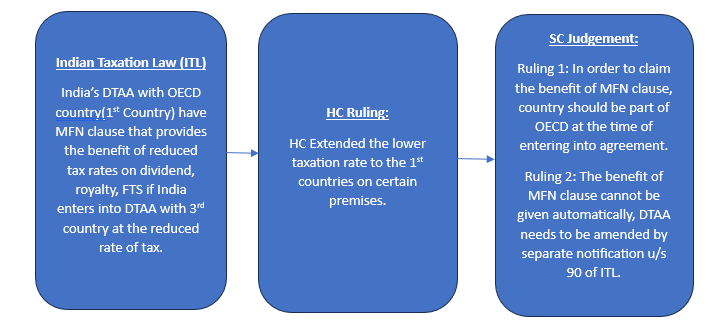

The Hon’ble supreme court in its landmark judgement in the case of Nestle SA, ruled in favour of the Revenue on certain aspects related to Most Favoured Nation (MFN) clause in the tax treaties. This judgement may have considerable implications on the assessee who have obtained treaty benefits in the past.

A Closer Look: Background on Indian Taxation Law

The Indian Constitution empowers the Union of India to engage in international tax treaties. Several of India’s Double Taxation Avoidance Agreements (DTAA) with OECD countries feature the MFN clause. This clause stipulates that if, after entry into force of the tax treaty with the first country, India enters into DTAA with the third country which becomes the part of OECD on a later date, providing a technical beneficial rate of taxation on dividend, interest, royalty, a similar benefit to be accorded to the first country.

Let’s illustrate the application of the MFN clause with an example:

The dividend article of the India-Netherlands (India-NL) DTAA specifies that dividends paid by Indian entities to Netherlands residents are subject to a 10% tax rate. The DTAA also includes an MFN clause that states that if India later signs a DTAA with a third country (a non-OECD member at the time of signing) that offers a more advantageous tax rate, India-NL DTAA should also enjoy similar benefits. Subsequently, India entered into DTAA agreements with countries like Slovenia and Colombia (third countries), which provided for a 5% tax rate on dividends. However, it’s important to note that these countries were not OECD members at the time of signing their respective DTAA agreements; they joined the OECD at a later date.

Delhi High Court Ruling:

The Delhi High Court interpreted the MFN clause to extend the benefit of lower withholding tax (5% on dividend income) as available in India’s DTAA with Slovenia, Lithuania, etc. This interpretation was based on two key premises:

- The use of the word “is” in the phrase “which is a member of OECD” in the MFN clause implies that the countries should be OECD members when India’s source taxation is triggered, not at the time of the original DTAA signing.

- There is no requirement for a separate notification to avail of the reduced tax rate.

Supreme Court Judgement:

The Supreme Court examined two primary issues:

Issue 1: Whether a taxpayer has the right to invoke the MFN clause when the third-party country with which India has a DTAA was not an OECD member at the time of entering into the DTAA but became an OECD member later.

SC Ruling: The Supreme Court concluded that for a taxpayer to claim the MFN clause’s benefits based on the entry into a DTAA of India with another state that is an OECD member, the relevant date is the DTAA’s signing date. It is not a later date when the country becomes an OECD member after signing the DTAA with India.

Issue 2: Whether the MFN clause should automatically take effect or if it requires a separate notification.

SC Ruling: The Supreme Court clarified that the MFN clause in a DTAA does not automatically trigger the extension of benefits covered in the DTAA with a third country. In such cases, the terms of the earlier DTAA need to be amended through a separate notification under Section 90 of Indian Tax Law.

Conclusion:

The Supreme Court’s ruling addresses the application of the MFN clause and underscores that it does not automatically come into effect with the signing of a tax treaty with another country. This judgment has important implications in the context of retrospective taxation.

This revision provides a clearer and more concise overview of the Supreme Court’s judgment regarding the MFN clause in tax treaties.

In a Nutshell: