Simply put, inheritance laws, also known as succession laws, play a guardian role. They ensure that rightful heirs get their due without the mess of legal disputes, family tussles, or potential scams. In a land as diverse as India, it’s no surprise that different communities have their unique rules for passing on assets, whether through will or upon one’s demise.

So, whether you’re curious about your rights, or looking to avoid the headaches of property disputes, dive into this crisp breakdown of India’s Property Inheritance Law. Let’s journey through its nuances together!

Property Inheritance in India: A Quick Guide

What is Property Inheritance?

It’s the legal passing on of assets, titles, debts, and rights after the owner’s demise. Think of it like handing over a cherished family heirloom to the next generation.

Which Law Governs This?

Enter the Indian Succession Act of 1925. This act lays out the roadmap for how properties get passed down.

How Does Property Get Passed Down?

When There’s No Will – Intestate Succession: Here, if a property owner passes away without leaving a will, predefined laws step in. For Hindus, it’s the Hindu Succession Act of 1956. For Muslims, it’s guided by the Muslim Personal Laws Application Act.

When There’s a Will: If the owner left behind a will, it acts like a personal note on how they want their assets shared. The best part? They can leave it to anyone, related or not. The official term, as described in Section 2(h) of the Indian Succession Act, is a legal declaration showing the owner’s wishes for their assets after they’re gone.

In a nutshell, whether you’re following a legal roadmap or a personal letter, India’s laws ensure a property finds its next rightful home.

Unravelling Types of Inherited Property in India

India’s inheritance landscape is broadly split into two:

Ancestral Property: Think of this as a legacy passed down through over three generations. It’s like a family heirloom, inherited and then passed on naturally to the next in line.

Self-Acquired Property: These are properties one buys or earns during their lifetime. It’s not part of a lineage gift but a personal acquisition.

To truly grasp the nuances of property inheritance, diving deeper into both Hindu and Muslim Inheritance Laws is key. This helps paint a clearer picture of how these assets find their next home.

Understanding Hindu Inheritance Law in India

Demystifying the Hindu Inheritance Law: An Easy Guide

The Hindu Succession Act, 1956, is the main playbook for Hindus on how properties get passed on when someone dies. A few quick notes before we dive in:

This Act covers most of India, but Jammu and Kashmir get a pass.

Who’s under this Act? Not just Hindus. If you’re a Buddhist, Jain, or Sikh, this is your playbook too. However, Muslims, Christians, Parsis, and Jews have their own sets of rules.

Property Inheritance Under Hindu Law

Property inheritance under the Hindu law is divided into the following:

Testamentary Succession: In this process, the property is distributed when an individual dies by making a will.

Intestate Succession: This process involves the distribution of property by the Operation of Law when an individual dies without making a will.

Property Distribution

There are certain provisions related to the distribution of property, and they are listed below:

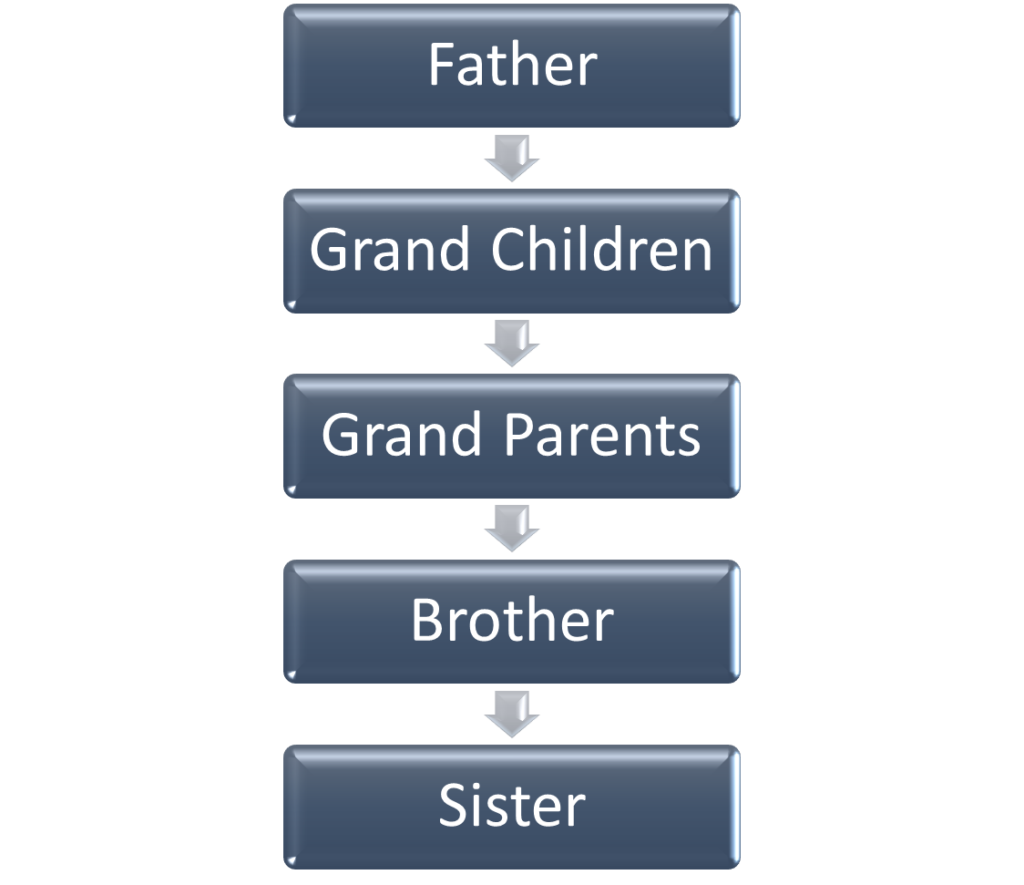

Property Division When Father Dies Intestate: The first division occurs among class I legal heirs. Amidst the absence of class I legal heirs, then the division happens between class II legal heirs. If both these legal heir classes are absent, then division happens among agnates of the deceased, and if they are not present then among the cognates.

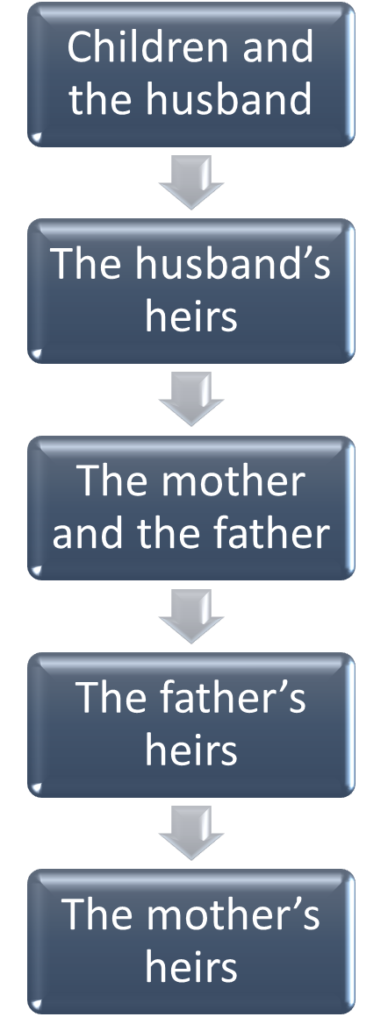

Property Division When Mother Dies Intestate: Under this circumstance, the property division happens among sons, daughters, and husbands. The second property division happens among heirs of husbands. In the third property division, the father and mother of the deceased are involved. The fourth division of property happens among the heirs of the father. Finally, the fifth property division occurs among heirs of the mother.

How Do Hindu Personal Laws Deal with Inheritance?

When a Hindu passes away, how does the property inheritance wheel spin? Here’s a simplified look:

For Hindu Males:

Class I Heirs: Get priority. Think immediate family – wife, kids.

Class II Heirs: They’re next in line if no Class I heirs are around. Think extended family.

Agnates & Cognates: Distant relatives on the paternal and maternal side respectively, they come into play if Class I & II heirs are missing.

No Legal Heir? The property knocks on the Government’s door and gets taken over; a process fancily called ‘Escheat’.

For Hindu Females:

Kids & Husband First: They’re the primary beneficiaries.

No Kids or Husband? Husband’s heirs step in.

Still No Heir Found? Her parents are next in line.

So, whether male or female, Hindu Personal Laws ensure properties find their rightful place in the vast family web.

Legal Heirs Under Hindu Law

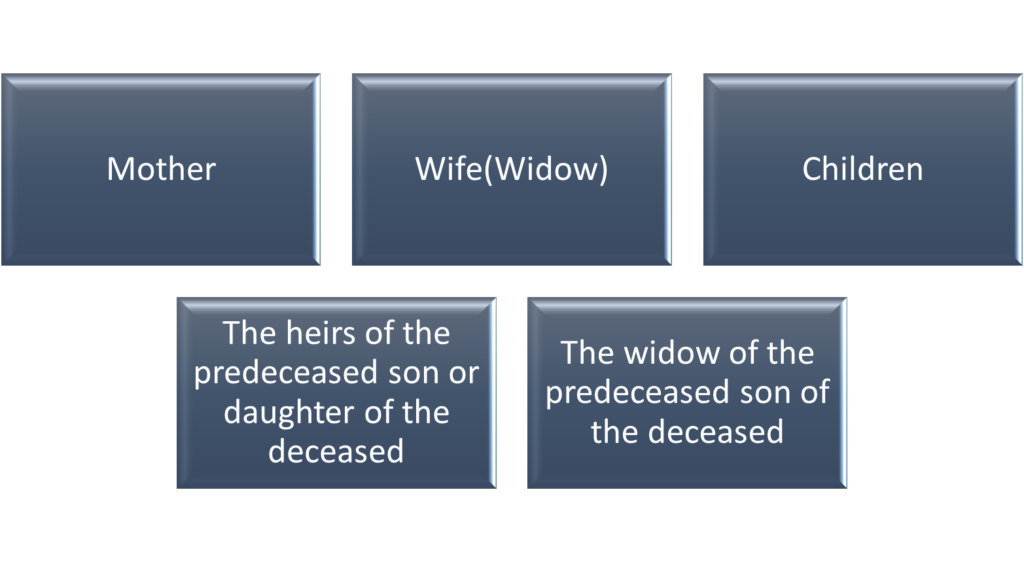

In case of Hindu males:

Class 1 Heirs: When a Hindu male dies intestate (without a will), leaving behind a widow, children, and mother, the property is distributed equally among them. Each of them is entitled to an equal share of the property.

Class 2 Heirs: The property is distributed among the Class II heirs in the order mentioned above. If there is more than one heir in a class, they share the property equally.

In addition to this, some of the important terms in relation to legal heirs in Hindu Succession laws are agnates and cognates.

Agnates: Under the Act, Section 3(1)(a) states the meaning of agnates – “one person is considered to be an agnate of another if the two are related by blood or adoption wholly through males”.

Cognates: Furthermore, Section 3(1)(b) of the same Act states the meaning of cognates – “one person is considered to be a cognate of another if both of them are related by blood or adoption but not wholly through males”.

In case of Hindu Females:

The property of a Hindu female dying intestate is to be transferred to:

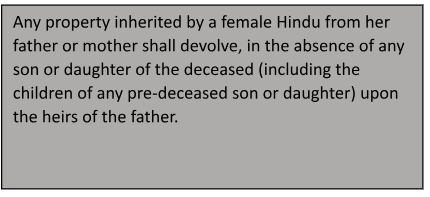

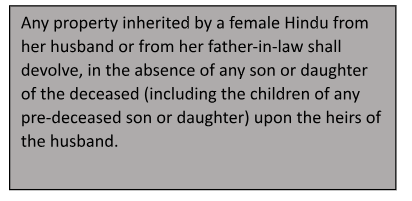

Two exception cases are there:

Documents required for legal heir certificate

- Deceased person’s name

- The relationship and the name of the applicant with the deceased person

- Applicant’s signature

- Applicant’s residential address

According to this Act, the viability of this will is justified if a testator was a competent person with mental soundness and is not minor. Considering all factors mentioned in the will, the Court ensures there isn’t a fraudulent purpose or partial clause. Reach out to us at saturnconsultinggroup.com.