Systematic Investment Plans (SIPs) have gained immense popularity among investors in recent years, owing to their versatility and convenience. They are not just easy to use; they are also a highly effective method of investing in mutual funds. The number of SIP accounts has been steadily increasing year by year. If you’re considering starting your SIP but aren’t sure how, this article provides the guidance you need. Establishing a SIP may require some initial effort, but once it’s set up, it puts wealth creation on autopilot. Let’s begin by understanding what SIPs are and how to invest in them.

What is a SIP?

SIP stands for Systematic Investment Plan. With SIPs, you systematically invest in market-linked funds like Unit Linked Insurance Plans (ULIP) and mutual funds. A SIP investment fund to invest in India is offered to you through various Insurance companies, fund houses, and other financial institutions. The best SIP plans offered by these fund management institutions have given very high returns to disciplined investors even during volatile market scenarios.

You can start a SIP with as little as Rs. 100, and there’s typically no maximum limit.

You’ll also need to select the SIP interval, such as weekly, monthly, or quarterly. Monthly intervals are the most popular since they align with the income schedule of most salaried individuals.

SIPs enable you to build a substantial corpus through modest investments. Additionally, they allow you to average your investment cost through a phenomenon known as rupee cost averaging.

Finally, SIPs promote discipline in your investment behavior and assist you in achieving your financial goals.

How Does SIP Work?

To understand how SIPs function, it’s crucial to grasp the process. When you establish your SIP, a fixed amount is automatically debited from your chosen bank account. The frequency of SIP can be daily, weekly, monthly, quarterly, semi-annually, or annually. Once the amount is debited, the fund house processes your transaction, and you receive mutual fund units based on the current Net Asset Value (NAV) of the fund. With each SIP, you receive units in line with the latest NAV, resulting in variations in the number of units in each transaction.

To illustrate, if you initiate a SIP of Rs. 5,000, and the current NAV is Rs. 100, you’ll receive 50 units (Rs. 5,000 / Rs. 100). If, during your next SIP, the NAV rises to Rs. 110, you’ll receive approximately 45.45 units.

Why Invest in SIP?

The most important benefits of investing through the SIP route are:

- You can start a SIP with a low amount of money: One of the most significant advantages of SIP is that you can start your investment journey with a minimal amount, often as low as Rs. 100. This low entry point makes it accessible to a wide range of investors, including those just starting their investment journey.

- Automated investment brings discipline: SIP instills a sense of financial discipline as it automates the investment process. Once set up, your chosen investment amount is automatically deducted from your bank account at regular intervals and invested in the mutual fund of your choice. This eliminates the need for constant manual intervention and ensures you stick to your investment plan.

- No need to time the market: Unlike lump-sum investments that may require precise market timing, SIPs are not affected by market fluctuations. They operate on a regular, fixed schedule, allowing you to invest irrespective of market conditions. This consistent investment approach helps average your investment costs over time, reducing the impact of market volatility.

- SIPs have total flexibility: SIPs offer investors flexibility on multiple fronts. You can adjust the investment amount according to your financial capacity and goals. Additionally, you can choose between monthly and quarterly investment frequencies. SIPs do not impose a lock-in period, meaning you can skip an installment or modify, cancel, or resume your SIP as needed.

Note: Only Tax Saving Mutual Funds have a lock-in period of 3 years and not other MFs.

- SIPs provide the benefit of Rupee Cost Averaging: SIPs leverage the power of rupee cost averaging. By investing a fixed amount regularly, you continue to invest regardless of market ups and downs. When the market is down, your investment buys more units with the same amount. Conversely, when prices rise, your investment purchases fewer units. This process smoothens the impact of market volatility over time.

Note: Rupee cost averaging is more likely to work over the long term. So, you need to continue your SIPs for the long term to reap maximum benefits.

- SIPs help create wealth with small amounts: SIPs provide an effective way to create wealth through regular, systematic investments. As your investment portfolio grows over time, it benefits from the power of compounding. Compounding is the reinvestment of returns at the same rate to generate additional income. In simple terms, it’s earning income on the income, which accelerates wealth creation.

Note: Compounding works exponentially over time. So, the longer you remain invested, the better returns you will get with the power of compounding.

How Does Compounding Work?

Compounding benefits of SIP:

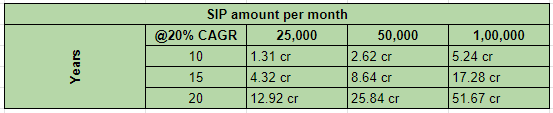

This matrix shows the final value of SIP after 10, 15, and 20 years. The SIP amount has been increased per year by 10%.

Rationale- As income grows, investment amount is also expected to increase.

For example- You start with Rs. 25,000/- month and increase this amount every year by 10%. Year 1- Rs 25,000/month, Year 2- Rs 27,500/month, Year 3- Rs 30250/month and so on.

Ques. Guess how much amount you must invest for 15 years starting with an SIP of 50,000 to get 8.64 Cr?

Ans. Investment of Rs. 1.9 Cr would give you Rs. 8.64 Cr.

How to invest in SIP?

Initiating SIP investments involves several steps:

Step 1: Gather the Necessary Documents

Collect essential documents for the process, including Proof of Identity (POI), Proof of Address (POA), PAN card, and bank account details. Ensure that your bank account information is accurate. You may also need a copy of your passport or driver’s license for KYC (Know Your Customer) compliance.

Step 2: Complete Your KYC

Once your documents are in order, proceed with the KYC process, which verifies your identity and address through the submission of required documents. This step involves providing basic details like your name, address, PAN number, bank details, and nominations. KYC can be completed either by visiting an Asset Management Company (AMC) or a Registrar and Transfer Agent (RTA) office, or by doing it online.

Step 3: Register for a SIP

After successfully completing your KYC, proceed to register for SIP. This step can be done online by visiting the website or app of an Asset Management Company (AMC) or a broker. You’ll need to create an account by providing basic details and complete the registration process. Alternatively, you can register for SIP in offline mode by physically visiting the AMC or broker’s office and submitting the filled form.

Step 4: Choose the Right Fund

While registering for SIP, you’ll need to specify the fund in which you wish to invest. Choose a scheme that aligns with your risk tolerance, investment horizon, and financial goals. Before making your selection, analyze the fund’s past performance, composition, expense ratio, fund manager’s track record, and other relevant factors.

Step 5: Specify the SIP Amount and Date

Decide how much you want to invest, how frequently, and on what date. The specified SIP amount will be debited from your account regularly, so ensure your account maintains sufficient balance to avoid bank charges or penalties.

Step 6: Set Up Auto Debit

You can make your SIP payments manually or set up an auto-debit facility to automate your SIP payments. For auto-debit, complete an e-mandate form and provide authorization to deduct SIP funds from your bank account.

Step 7: Submit Your Form

After filling out the registration form, the final step is to submit it to your respective AMC or broker. Submission can be done through both online and offline methods.

- Offline Mode: If you choose to register offline, you must physically submit your form at the AMC or broker’s office. Attach necessary documents, such as a copy of your Proof of Identity (POI), Proof of Address (POA), PAN card, and a canceled check, along with your form.

- Online Mode: In the online mode, you’ll upload essential KYC documents with your registration form and submit it after all required documents have been uploaded.

Once the registration form is submitted, the AMC or broker will open your account, and you can commence your SIP investment journey.

SIP Calculator

Calculating your SIP returns is vital for measuring your investment success. Use an SIP calculator to determine the future value of your investment and assess whether it aligns with your financial goals. Seek financial advice to make informed investment decisions and consult with a financial advisor before starting your mutual fund SIP.

Points to Consider Before Starting Your SIP

Before investing through SIPs, take these factors into account to ensure that SIPs align with your investment goals and objectives:

- Investment Goals: Different mutual fund schemes are designed to meet specific objectives, so choose schemes based on your investment goals. For long-term goals like retirement, equity funds are ideal. Hybrid funds are suitable for medium-term goals, while debt funds are suitable for short-term goals.

- Investment Horizon: Consider your investment horizon and the number of years you intend to invest. Choose the SIP tenure that aligns with your requirements. For example, if you plan to purchase a car in 5 years, consider Aggressive Hybrid Mutual Funds. For goals 7-10 years away, you can invest in equity funds.

- Risk Appetite: Your risk appetite influences your investment decisions. If you’re willing to take higher risks, you can consider SIPs in equity funds. For a more conservative approach, opt for hybrid or debt funds. Factors like age and financial goals can impact your risk tolerance.

- Fund Performance: Examine a fund’s track record, consistency, and returns to assess its suitability.

- Fund Manager: Consider the fund manager’s experience, investment style, and track record before investing.

- Charges: Asset Management Companies charge an expense ratio for managing your investments. Compare expense ratios across fund categories and take note of exit loads (charges for early exits) and other associated fees.

Conclusion

SIPs are an excellent choice for mutual fund investing, placing your investments and wealth creation on autopilot. Discipline is key in staying committed to your SIPs. To monitor performance and understand the growth of your wealth over time, consider using an SIP Return Calculator App. Additionally, remember to increase your SIP contributions annually to achieve your goals more quickly and build a larger investment corpus. Starting early allows your SIPs more time to compound and harness the power of compounding.