Income tax regulations and benefits available to NRI differ significantly from those available to resident Indian.

When Do NRIs Face Taxation on Their Earnings in India?

Non-resident taxable income includes:

- Income received or deemed to be received in India

- Income which accrue or arise or deemed to accrue arise in India

In cases where the Govt. of India remits salary or income in favour of any Indian citizen rendering services outside India, the same shall be considered as Indian income as it is presumed to have arise in India and shall be chargeable to tax as per Indian laws. Specific exemptions are provided to the income of diplomats and ambassadors.

The following are income of non-resident that will be termed as income accrue or arise in India:

- Income from business running in India

- Income from property, asset or any other source of income existing in India.

- Capital gain arising out of transfer of a capital asset situated in India

- Income arising out of any service rendered to the govt of India outside India, when NRI was a citizen of India. Such a situation arises when the officer deputed in India missions, consulates and embassies abroad.

- Dividend paid by an Indian company

- Interest, technical fees or royalty received from the Central or State Govt.

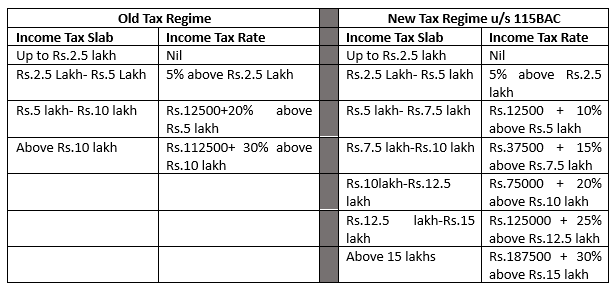

Tax Slab Applicable in case of NRI

**Note: The taxpayer opting for concessional rates in the new tax regime will not be allowed certain exemptions and deductions (like 80C, 80D, 80TTB, HRA, etc) available in the existing tax regime.

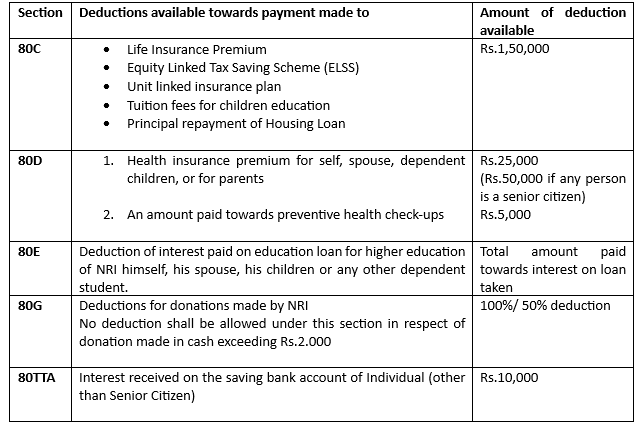

Some Deduction benefits available are:

When Do NRIs Need to File Income Tax Returns in India?

NRI needs to comply with the Indian Taxation laws and are required to file their Income Tax Return mandatorily in the following cases:

- Taxable income is more than the basic exemption limit of Rs.250000.

- When NRI wants to claim refund of tax paid

- If NRI has any loss in any transaction related to an investment or asset in India and wants to carry forward the loss to next financial year.

- When NRI has long term capital gain or short-term capital gain. In such cases benefit of basic exemption limit is not available in respect of such gains.

ITR Filing Deadline for Non-Residents in India

The standard deadline to file an Income Tax Return in India is 31st July of the subsequent financial year. However, for NRIs who are active partners in firms requiring account audits, the deadline extends to 31st October.

Are NRIs Obligated to Pay Advance Tax?

Even the NRI come under the ambit of advance tax. If the estimated tax liability for the financial year is more than Rs.10,000, then person is required to pay advance tax liability in four instalments.

FAQs

Ques: For returning NRI, what will be the tax treatment of the deposits in the FCNR Account?

Ans: Upon change in residential status from NRI to resident, Interest income earned in FCNR deposit shall become taxable. Interest income earned in FCNR account is exempt as long as you are NRI or Resident but not Ordinary resident (RNOR).

Ques: Is the Indian student studying abroad consider as NRI for income tax purposes?

Ans: Yes, Indian student studying abroad will be treated as NRI and are eligible for all the facilities available to NRI’s

Ques: What is the tax implication on NRI inheriting agricultural land?

Ans: An NRI inheriting agricultural land is not taxable.

Ques: Whether tax is required to be paid again in India on the salary earned in foreign country credited to Indian saving account, if the tax is already paid on such income in the foreign country?

Ans: Income earned overseas will be taxed in India. If the tax has been paid in another country tax credit can be claimed in India.