India’s economic landscape continually evolves, driven by innovation and changing consumer preferences. Several emerging sectors are at the forefront of this transformation, offering exciting opportunities for investors and job seekers. India is witnessing remarkable growth from the booming technology and startup ecosystem to the renewable energy industry. The country’s robust pharmaceutical and healthcare sector, as well as its evolving e-commerce and fintech industries, are also contributing significantly to its economic expansion. Additionally, India’s focus on sustainable practices and green technologies is paving the way for advancements in electric vehicles and renewable energy, further positioning the nation as a key player on the global economic stage.

This article gives you insights into India’s top two emerging sectors, Fintech and Renewable Energy, your proposition to invest, and everything else you should know about these sectors. Do come back to this space for the following two sectors: healthcare and E-commerce, which we discuss in our follow-up blog.

The Fintech sector of India

Coin Stack Icon on Business and Finance Vector Background. The blue button with the white icon is in the illustration’s center. Business and finance icon patterns surround the button. The icons vary in size and shades of blue color. There is a white glow around the round button, which helps it stand out from the background. The icons include popular business and finance symbols such as business people, business meetings and travel, profits and financial charts, and many more. You can also use each icon separately from the main background.

The term fintech is a combination of financial and technology. It refers to the sector encompassing companies and technologies that provide innovative financial services and solutions by leveraging technology and digital platforms. Fintech companies aim to disrupt and enhance traditional financial services by offering more accessible, efficient, and user-friendly alternatives.

The Fintech sector has seen spectacular growth in India over the past 10 years since it acquired traction after the country adopted internet services. With a global average acceptance rate of 64%, India has one of the fastest-growing fintech markets in the world, with an adoption rate of 87%.

India, which has had significant growth in recent years aided by the expanding internet adoption, nevertheless has 190 million people who need access to banking services, making it the country with the second-largest population without such access. This calls for the secure nationwide expansion of technology-based financial services.

Fintech Sector: Market Overview

- The Indian FinTech industry’s market size is $ 50 Bn in 2021, estimated at ~$ 150 Bn by 2025.

- Currently, there are 25 Fintech unicorns in India.

- 75% of all retail digital payments in India are UPI.

- India’s digital lending market was worth $ 270 billion in 2022 and is expected to reach $ 350 billion by 2023.

- The Fintech sector in India has witnessed funding accounting for a 14% share of Global Funding, $34bn Fintech funding received between 2014-2022.

- India ranks #2 on Deal Volume. The volume of UPI transactions increased 200x from January 2017 (4.5 Mn) to January 2023 (10 Bn), and the Value increased 600x during the same period.

- The Fintech Market Opportunity is estimated to be USD 2.1 Tn by 2030. Indian fintechs were India’s second-most funded startup sector in 2022; Indian fintech startups raised USD 5.65 billion in 2022.

Government Initiatives in the Fintech Sector

- JAM Trinity

- Jan Dhan Yojana: The world’s largest financial inclusion initiative, “Jan Dhan Yojna”, has helped new bank account enrolment of over 480 Mn beneficiaries.

- Aadhaar: The world’s most extensive biometric identification system (1.3+ Bn Aadhaars generated so far)

- Mobile connectivity: India has the 2nd highest number of smartphone users

- India Stack: IndiaStack is a set of APIs that allows governments, businesses, startups, and developers to utilize a unique digital Infrastructure to solve India’s challenging problems towards presence-less, paperless, and cashless service delivery.

- Cross-border linkage of India’s fast payment systems (UPI & RuPay network – QR code & P2M based payments) with other countries enhances the global footprint.

- Financial Inclusion: India’s financial inclusion has improved significantly over calendar years 2014 to 2021 as the adult population with bank accounts increased from 53% to 78%

- Financial Literacy: The RBI has set up the National Centre for Financial Education and plans to expand the reach of Centres for Financial Literacy (CFLs) to every block of the country. These steps aim to promote financial education across India for all sections of the population.

- Digital Rupee: India recently launched its Central Bank Digital Currency (CBDC), digital rupee, or e-rupee.It is an electronic equivalent to cash and will largely hasten the expansion of India’s FinTech business.

- UPI (Unified Payments Interface): The National Payments Corporation of India created a cutting-edge mobile app-based payment mechanism to transfer money across bank accounts in 2016. It is the driving force behind India’s Fintech boom.

- More than 338 banks are registered with UPI, and in July 2022, there were more than 6.28 billion transactions totaling 10.62 lakh crore.

The road ahead for the fintech sector of India

- Consumer Awareness: Besides establishing technological safeguards, educating and training customers will help democratize fintech and guard against cyberattacks. The National Payments Corporation of India developed a cutting-edge mobile app-based payment system to transfer money across bank accounts in 2016. It is what is causing the Fintech growth in India. In July 2022, there were more than 6.28 billion transactions totaling $10.62 lakh crore, with more than 338 banks enrolling with UPI.

- Maintaining Data Privacy: The regulatory framework for fintech companies to manage their data can be framed through a collaboration between the Ministries of Corporate Affairs and Electronics and Information Technology. The Government should require fintech companies to ensure that the data harvested from consumers will not be used for any purpose other than serving the consumer’s interests.

Renewable Energy sector of India

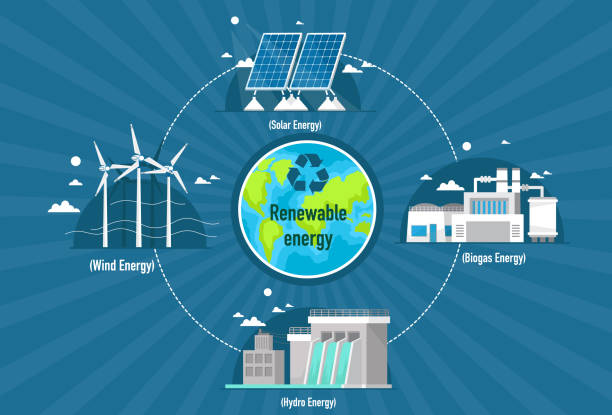

For a clean and sustainable world, renewable energy is used to reduce pollution, such as biopower plants, hydroelectric plants, wind turbines, and solar cells.

Renewable energy is the energy obtained from natural sources that is recharged at a higher rate than consumed, creating far lower carbon emissions than burning fossil fuels. The Indian renewable energy market is fragmented by source. The market is segmented by source into wind, solar, hydro, bioenergy, and other sources.

India’s competitive advantage lies in:

- India stands 4th globally in Renewable Energy Installed Capacity (including Large Hydro)

- 4th in Wind Power capacity

- 4th in Solar Power capacity (as per REN21 Renewables 2022 Global Status Report)

- India is the 3rd largest energy-consuming country in the world.

Market size of the renewable energy sector of India

- As of October 2022, India’s installed renewable energy capacity (including hydro) stood at 165.94 GW, representing 40.6% of the overall installed power capacity.

- The country is targeting about 450 Gigawatt (GW) of installed renewable energy capacity by 2030 – about 280 GW (over 60%) is expected from solar.

- The non-hydro renewable energy capacity addition stood at 4.2 GW for the first three months of FY23 against 2.6 GW for the first three months of FY22.

- Solar power installed capacity has increased by more than 18 times, from 2.63 GW in March 2014 to 49.3 GW at the end of 2021. From 2022 until November, India has added 12 GW of solar power capacity.

- Power generation from renewable energy sources (not including hydro) stood at 16.18 billion units (BU) in September 2022, up from 14.49 in September 2021.

- With a potential capacity of 363 GW and with policies focused on the renewable energy sector,

Northern India is expected to become the hub for renewable energy in India. FDI of up to 100% is allowed in the renewable energy industry under the automatic route, with no prior government approval needed. Up to 100% FDI is allowed under the automatic route for renewable energy generation and distribution projects subject to provisions of The Electricity Act 2003.

Policy Support

- In the Union Budget 2022-23, the Government allocated Rs. 19,500 crore (US$ 2.57 billion) for a PLI scheme to boost manufacturing of high-efficiency solar modules.

- India launched the Mission Innovation CleanTech Exchange, a global initiative that will help accelerate clean energy innovation.

- The Government of India wants to develop a ‘green city’ in every state powered by renewable energy. The ‘green city’ will mainstream environment-friendly power through solar rooftop systems on all its houses, solar parks on the city’s outskirts, waste-to-energy plants, and electric mobility-enabled public transport systems.

The road ahead for the renewable energy sector of India

India has set a target to reduce the carbon intensity of the nation’s economy by less than 45% by the end of the decade, achieve 50% cumulative electric power installed by 2030 from renewables, and achieve net-zero carbon emissions by 2070. Low-carbon technologies could create a market worth up to US$ 80 billion in India by 2030. By 2040, around 49% of the total electricity is expected to be generated by renewable energy as more efficient batteries will be used to store electricity, cutting the solar energy cost by 66% compared to the current cost. Using renewables in place of coal will save India Rs. 54,000 crore (US$ 8.43 billion) annually. Around 15,000 MW of wind-solar hybrid capacity is expected to be added between 2020-25.

Stay tuned for part two, discussing India’s healthcare and E-commerce sector.

Pingback: Emerging Sectors of Indian Economy: Healthcare & E-Commerce