Term life insurance is a life insurance that provides coverage for a limited period of time at a fixed rate of payments/premium. For example, at a monthly payment of Rs. 1000, you can insure your family with an amount as high as Rs. 1 crore for a particular term. It replicates your existence in your absence and helps your family support themselves in case of your passing away. Term Insurance keeps your loved ones financially stable when you’re no longer the breadwinner. The beneficiaries listed in your policy—typically one or more family members—receive the death benefit. The lump sum/ regular payments after death are not subject to income tax.

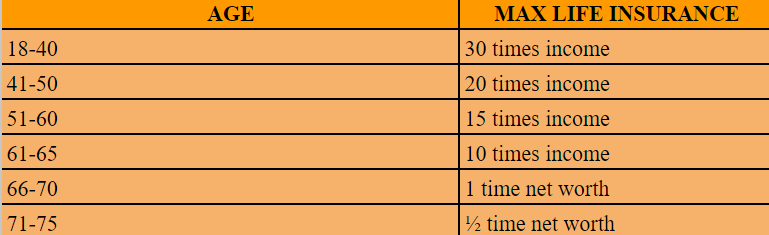

What is the ideal amount you would need to replace yourself financially?

The sum assured should be able to cover your monthly expenses until your family can become stable, inflation throughout the term, and any EMIs/ financial liabilities.

The most basic recommendation is to multiply your salary by a number based on your age, profession, anticipated working years, and current benefits. Also, adjust this amount as per the inflation rate in your country. Please refer to the chart because the computation varies depending on your age group:

Why not Whole Life Insurance?

Whole Life Insurance serves you throughout your life without any term restrictions. Sounds better? Though it is for a whole life, the only problem is after a certain age, your family will not be dependent, and you and the premium of Whole Life Insurance is very high compared to Term Life Insurance. Instead, you can take term insurance and invest the excess premium in LIC or growth opportunities like PPF, Mutual Funds, etc. For Example- Your age is 35 years. At this age, you should opt for a duration of 20-25 years, depending on your financial needs and retirement plans or employment type.

Good Insurance Provider: Here are the green flags to look for

- Financially strong: You want to be confident that the company will be around when your family needs a death benefit payout years down the road. Look for insurers with solid ratings.

- No underwriting of policies: Some businesses offer coverage from different insurers. When your family requires a payment later on, this could raise the cost of your premiums and add another layer to the process if you wish to change your policy.

- Guaranteed term renewability: Nearing the conclusion of your term, you’ll wish to be able to renew without having to undergo another medical examination. Some businesses offer this annually; while you can expect significant fee increases, depending on your circumstances, it can be worthwhile.

- High Claim Settlement Ratio: It is the Number of Claims Settled out of the total number of claims received.

- High Amount Settlement Ratio: The amount settled as against the total request amount for settlement. Companies with High CSR might not settle high-value claims, which can be ascertained from this ratio.

- Low Claim Rejection Ratio: Number of claims rejected by the company out of the total number of claims received.

You can check these ratios in the IRDAI report, or you can also check the website of Insurance providers.

Some Riders which you can avail

- Critical Illness- Any severe health issue like cancer because of which you cannot pay the premiums.

- Accidental Disability- If an accident makes you incapable of paying the premiums

These riders promise a lump sum if the life assured meets an accident or gets diagnosed during the policy tenure.

Even though the term is the simplest form of life insurance coverage, it helps to talk things over with a knowledgeable professional before you buy. Whichever way you choose to explore your options, do it soon. Remember: the longer you wait for life insurance, the more you pay.

If you are still confused, reach out to us at info@saturnconsultinggroup.com