Regarding investments, the Reserve Bank of India (RBI) introduced a game-changing opportunity for retail investors in 2021. The RBI Retail Direct Scheme aims to empower individuals nationwide to explore the world of Government Securities, mainly long-dated bonds and treasury bills (T-bills). But what exactly is this scheme, and how can it benefit you?

Understanding RBI Retail Direct

IN ITS SIMPLEST FORM, the RBI Retail Direct Scheme is a platform that lets retail investors purchase and sell government securities directly from the RBI. Previously, these opportunities were primarily available through secondary markets or mutual funds. However, this new initiative democratizes the investment landscape, putting the power directly into the hands of the individual investor.

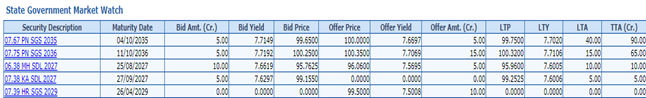

A tradeable instrument known as “Government Security” (G-Sec) is a product of India’s Central or State Governments. These can be short-term treasury bills (with maturities under one year) or long-term bonds (with maturities over one year). While the Central Government issues both types, State Governments issue only long-term bonds, known as State Development Loans (SDLs). Given their government backing, G-Secs are considered risk-free and often called gilt-edged instruments.

Where can you invest via the RBI Retail Direct Scheme?

There are four main types of securities that people can invest in via the RBI Retail Direct platform:

- Dated G-Secs: Long-term bonds issued by the Indian Government. They have fixed or variable interest rates, paid semi-annually, and can range from 5 to 40 years.

The coupon, issuer’s name, and maturity year are all included in the nomenclature of a conventional dated fixed coupon G-Sec.

For example, – 7.17GS2028 would mean:

Coupon: 7.17% paid on face value

Name of Issuer: Government of India

Date of Issue: January 8, 2018

Maturity: January 8, 2028

Coupon payment dates: Half-yearly (July 08 and January 08) every year

Minimum amount of issue/sale: ₹10,000

2. Treasury Bills (T-Bills): Short-term debt tools from the Government of India. T-bills don’t offer interest; they’re bought at a discount and redeemed at face value. They come in three durations: 91, 182, and 364 days.

For instance, a 91-day Treasury bill with a face value of $100 might be issued for 98.20 or at a discount of, say, 1.80 and redeemed for $100. The yield on Treasury Bills is calculated as the difference between the maturity value, also known as the face value, which is 100, and the issue price.

3. State Development Loans: Long-term securities issued by State Governments to borrow for over a year.

4. Sovereign Gold Bonds (SGBs): Government-backed securities equivalent to grams of Gold. They’re alternatives to physical Gold, with a minimum investment of 1g and a maximum of 4 kg for individual investors. Prices of these bonds are linked to the market price of Gold.

On the initial investment amount, the Bonds pay interest at a set rate of 2.50 percent annually. Interest credits will be credited to the investor’s bank account twice a year; the last interest payment and the principal are required at maturity.

Note: The minimum amount you can invest in Dated G-Secs, T-Bills, and SDLs is Rs. 10,000.

How are G-Secs traded?

G-Secs can be traded in the secondary market. There are multiple platforms for trading:

- NDS-OM (Negotiated Dealing System-Order Matching): is the RBI’s electronic platform introduced in August 2005 for trading government securities. You can visit https://retail.ndsom.com/Home/Login to make your NDS-OM account. This portal also allows you to monitor the securities market to check prices. Direct access to NDS-OM is usually reserved for select financial institutions like Commercial Banks, Primary Dealers, and certain other eligible entities.

- OTC (Over-the-Counter trading): Before the introduction of NDS, India’s government securities were primarily traded through phone orders and manual paperwork. Trades were conducted over calls, with settlements involving physical transfer forms and checks issued to the RBI. This is called OTC trading.

- NDS-OM-Web: an online interface that provides retail investors and other participants access to the NDS-OM platform, but in a more user-friendly way and suited for non-institutional participants. It’s primarily designed for retail participants, allowing them to access the government securities market through an online interface without requiring the infrastructure and setting up the primary NDS-OM system demands.

- Stock Exchanges like (NSE, BSE, etc.) have been asked to launch a debt trading (G-Secs and corporate bonds) segment, which generally caters to the needs of retail investors.

How Does it Work?

https://rbiretaildirect.in/#/login/Imagine this scenario: You’re looking to invest your hard-earned money in government bonds, considered one of the safest investment options. Traditionally, you might have needed to go through a complex process involving brokers or mutual funds to access these bonds. But with RBI Retail Direct, it’s as simple as creating an account and placing your order, just like online shopping!

The steps involved in the process are:

- Easy Registration: An investor begins by opening a “Retail Direct Gilt Account” with the RBI here: https://rbiretaildirect.in/#/login/. This online process is user-friendly and designed for individuals.

2. Direct Purchase: Once registered, you can directly buy and sell government securities through an online portal managed by the RBI.

3. Diverse Options: Whether you’re interested in treasury bills (short-term investments) or long-dated government bonds, the scheme provides a variety of choices.

Who is eligible to open an Retail Direct Gilt (RDG) Account?

In this regard, retail investors should meet the following criteria to open an RDG Account:

- In India, they have a rupee savings bank account.

- They have a Permanent Account Number (PAN) that the Income Tax Department issued.

- They can give any official valid document (OVD) for KYC reasons.

- They have a working email address.

- They have a mobile phone number.

The scheme is also open to non-resident retail investors authorized to invest in Government Securities under the Foreign Exchange Management Act 1999.

Note: An eligible retail investor can open an RDG account independently or in collaboration with another eligible retail investor.

Benefits of RBI Retail Direct

- Direct Access to Government Securities: This scheme lets you purchase government bonds and securities directly from the RBI. This means you’re investing at the source, eliminating intermediaries and their associated fees.

- Safety and Reliability: Government securities are among the safest investments available. With RBI Retail Direct, you’re investing in the credibility and stability of the Indian government.

- Low Entry Barrier: You don’t need to be a financial wizard to start investing. RBI Retail Direct welcomes investors with varying budgets, making it inclusive for all.

Real-Life Example

Let’s say you have ₹10,000 to invest. Previously, you might have opted for a fixed deposit or left it in a savings account. However, with RBI Retail Direct, you can invest it in government bonds with an annual interest rate of 6%. After a year, your investment would grow to ₹10,600. That’s ₹600 in earnings without breaking a sweat.

The RBI Retail Direct Scheme is a game-changer for retail investors in India. It opens the door to safe, reliable, and direct investments in government securities. RBI promotes financial inclusion and empowerment by eliminating intermediaries and providing easy access. So, why wait? Start your investment journey today and watch your money grow with the RBI Retail Direct Scheme.

If you are still confused, reach out to us at info@saturnconsultinggroup.com